Because we believe getting a mortgage loan must be accessible, efficient and transparent.

We advise you on how to obtain your mortgage loan in mexican pesos or american dollars with the best market conditions, an expert advice and our personalized attention. You are our priority.

Try our Mortgage Calculator!

Bursar Loans specializes in providing mortgage advice and management.

Bursar Loans specializes in providing mortgage advice and management through our alliances with the most important banks in Mexico. Our commitment is to make it easier for both Mexicans and foreigners to obtain a mortgage loan with flexible options adapted to their needs.

ABOUT US

Your dream, our mission. Trust the experts.

We facilitate obtaining mortgage loans for foreigners who want to buy real state in Mexico. We act as an intermediary between lenders (banks, financial entities) and clients seeking to acquire properties.

With a deep understanding of the mortgage market and a commitment to personalized service, Bursar Loans will help you find the perfect loan to fit your needs.

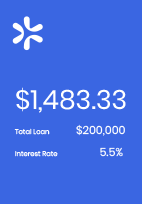

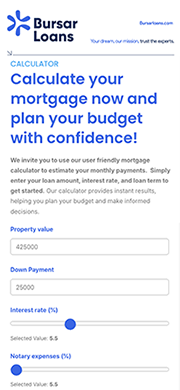

MORTGAGE CALCULATOR

Calculate your mortgage now and plan your budget with confidence

We invite you to try our user-friendly mortgage calculator to estimate your monthly payments and understand the outline of a mortgage

FAQ´S

Didn't find what you were looking for?

Whether you’re just starting out or are deep into your mortgage journey, you’ll find the information you need right here. If you don’t see your question listed, feel free to reach out. We are here to help.

It is a financing instrument to acquire, remodel, expand or build a home.

It is the formal authorization of the credit capacity (amount of the loan) based on your debt capacity. The approval requires you to share with us further documentation of your income and personal information.

Depending on the bank, the qualification validity may vary, but the average is 4 to 6 months. If the validity expires, you will simply need to update your proof of income.

Contact us and we will help you pre-qualify with the bank that best suits your needs. Each bank has its own metrics, but on average it is a 2-3 week process.

What are you waiting for to build your future?

It is an indicator of how much debt an individual can incur without putting his or her financial integrity at risk and without falling into default. CONDUSEF advises that debt should not exceed 35-40% of monthly net income. But the metric is different for each Bank.

You can calculate it as follows:

Payment Capacity = ( Total monthly expenses / Monthly income ) * 100

Consider your basic expenses for food, transportation, education, leisure, health, other debts you owe and the monthly payment of your new mortgage loan. The result should be less than 40% to be at a healthy level.

- Pre-qualification

- Credit application

- Delivery of file and credit analysis

- Authorization of the amount of the credit according to borrowing capacity.

- Appraisal of property

- Integration of the Trust file*.

- Notary and Trust* processes.

- Opening of client's account

- Signing of trust* and mortgage.

- Disbursement of authorized amount.

*If applicable.

Of course! You can buy a property in Mexico regardless of your immigration status. However, if you want to buy in a restricted zone, you will need to establish a restricted zone trust.

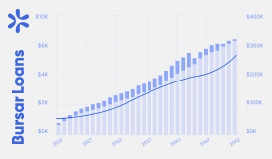

Blog & news

Stay updated with our latest mortgage news and insights!

CONTACT US

Ready to take the next step? Get in touch with us today!

We’d love to hear from you! Whether you have questions, need advice, or are ready to start your mortgage journey, our team is here to help. Contact us today to schedule an appointment and take the first step towards homeownership.